May 2020 Inflation Report

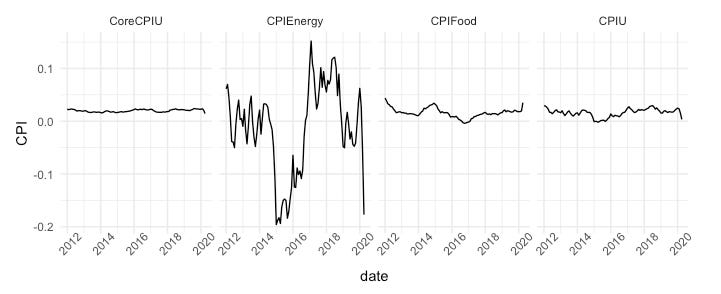

Some of the biggest news of the week was the release of the Consumer Price Index for April on May 12. The headline news was that the Consumer Price Index for All Urban Consumers fell 0.8% in April, the largest decline since December 2008, driven largely by the 20.6% fall in gasoline prices. If we exclude food and energy prices, the fall was still 0.4%, and was driven by 4.7% declines in both airline fares and apparel prices.

All food prices were up by 1.5%, led by food at home prices rising by 2.6%, compared with food away from home rising at only 0.1%. Food at home categories nearly all showed higher prices, with Meat, Poultry and Fish rising at 3.6% as a whole, and nearly every category rising with it, paced by Other Pork, including Roasts, Steaks & Ribs rising at 10.1%. Cereals and Bakery products were another strong category, with prices rising 2.9%, paced by Rice (3.6%), Fresh Biscuits, Rolls & Muffins at 4.7% and Cookies at 5.1%. Finally, eggs were another big riser at 16.1% from March to April.

April was the first month in which the majority of the country was locked down, but it was only in the latter half of the month that wide-spread closures of meat-packing plants started. We are just seeing the effects of the COVID pandemic in most of the economic data this month. For price changes, the impact is obvious in both food and energy, but is not widely obvious in the ‘core’ CPI data, outside of airline prices (for obvious reasons) and apparel, which is heavily driven by Men’s suits, sport coats, and outerwear, and women’s dresses categories.

The May numbers next month will show higher increases in food prices, compounded by a rise in gasoline prices. The more interesting question is always how much effect we will see in core consumption. With consumer spending only starting to recover in May, as the country reopens, price changes will be an early indicator of the resiliency of the US consumer.